HOW TO REGISTER A PRIVATE LIMITED COMPANY IN INDIA: STEP-BY-STEP GUIDE

Starting your own business? One of the most reliable and credible options if you want to establish your business is to register a Private Limited Company (Pvt Ltd). It provides more access to capital and partnerships, restricted liability, and a distinct legal personality.

The registration process is now simplified and mostly all work is online because of the Ministry of Corporate Affairs (MCA).

What Is a Private Limited Company?

The Companies Act of 2013 governs a particular kind of business entity called a private limited company. It needs at least two directors and two stockholders, who might be the same individuals. In India, the business must also have a registered office. This structure is perfect for family-run firms, startups, and growth-orientated companies because it offers: Restricted protection against responsibility

- Improved legal status

- Transfer of ownership is simple

- Qualifications for equity financing

How to Register a Private Limited Company in Steps

Step 1: Obtain the Digital Signature Certificates (DSC)

- All directors and shareholders are required to obtain a Class 3 Digital Signature Certificate because the entire registration process is digital.

- Issued by authorised government officials

- Processing takes just 30 minutes effectively

- Used to sign documents such as e-MoA, e-AoA, and SPICe+

Tip: For hassle-free DSC processing, pick a trustworthy organisation.

Step 2: Apply for Director Identification Number (DIN)

- DIN is a special number that each director of the company is given.

- The SPICe+ form allows new businesses to directly receive DINs (up to three).

- After incorporation, appoint extra directors if more than three lack DINs.

- The SPICe+ form now incorporates DINs, which facilitates application.

Step 3: Reserve Your Company Name

Selecting the appropriate name for your business is essential for branding and legal reasons. One of two approaches is available to you:

File SPICe+ Part-A: Before submitting the whole form, reserve a name. Two name choices are permitted by MCA, and if refused, there is one opportunity to reapply.

Combine Parts A and B into a file: Consolidate incorporation and name approval in one step. Make sure the name doesn’t sound like any trademarks, LLPs, or already-existing businesses.

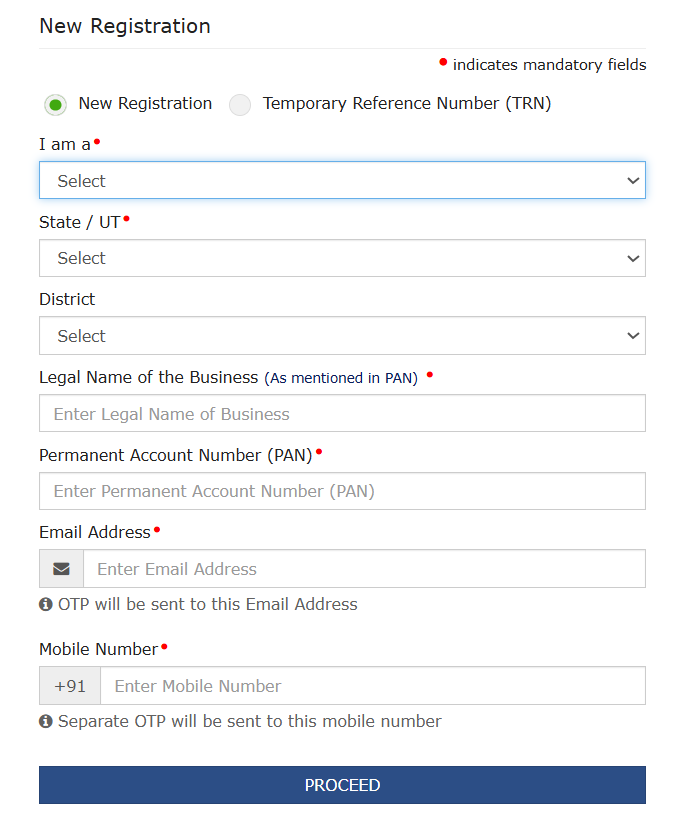

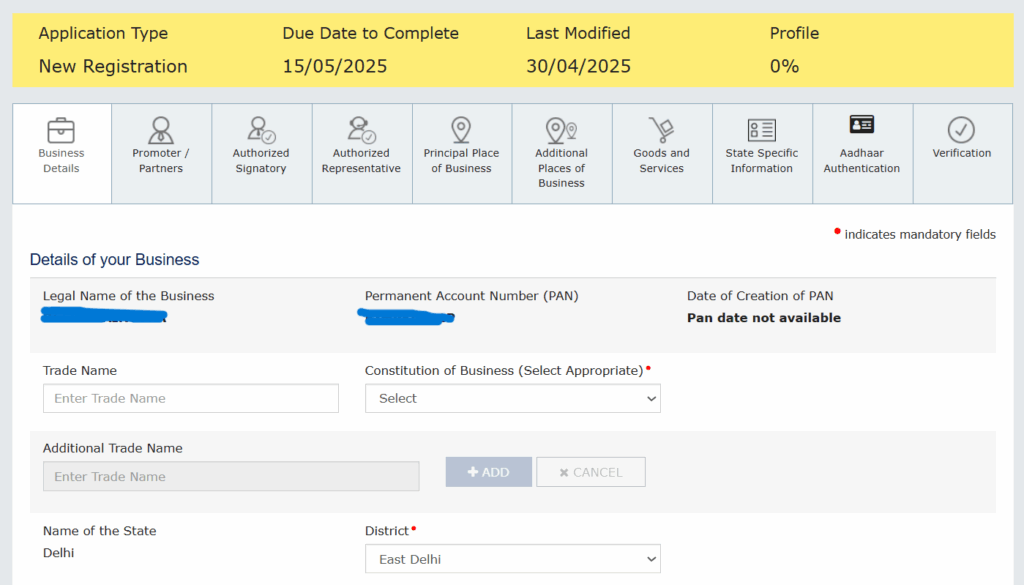

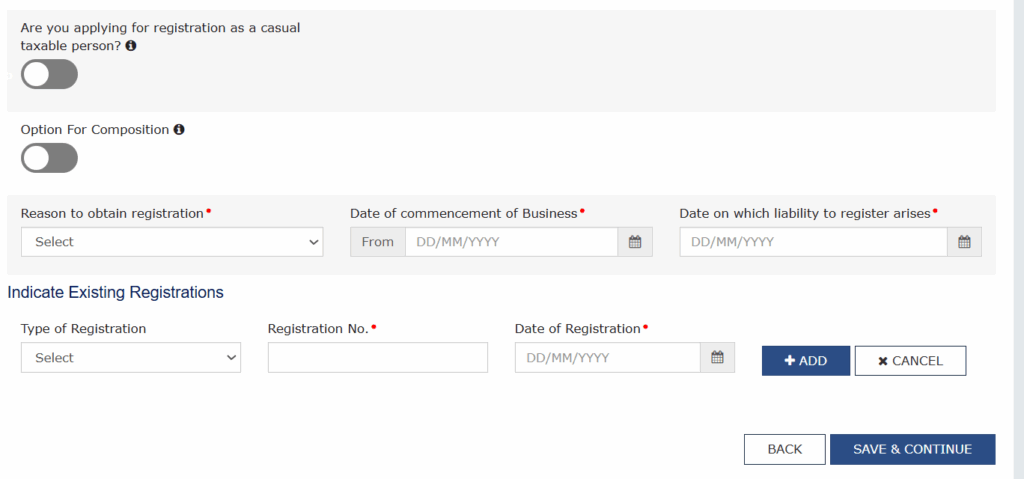

Step 4: Fill out the INC-32 SPICe+ Form

The simplified proforma for electronically incorporating a business, or SPICe+, is a form for:

- Reserving of a name

- DIN application

- Incorporation of a company

- TAN & PAN

- Registration of ESIC and EPFO

- GST (optional)

- Bank account

- Professional tax (if applicable)

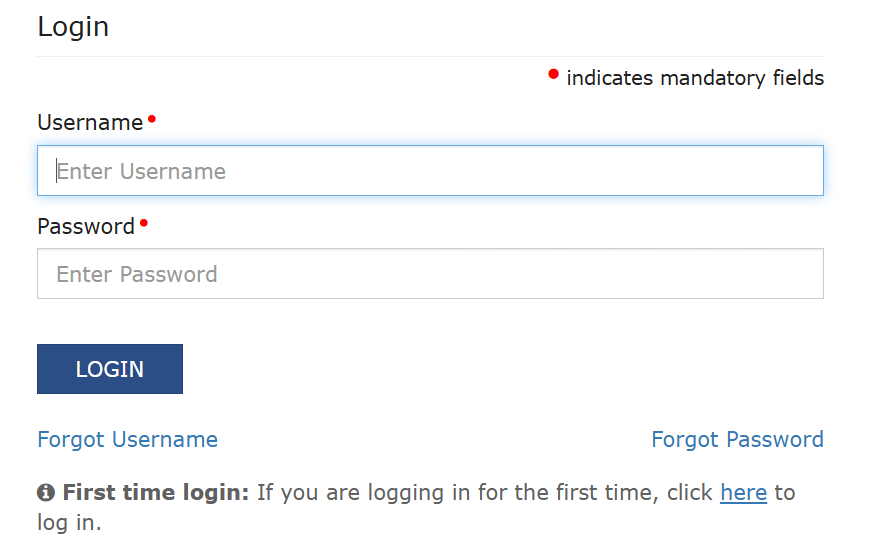

Complete the online form, save it to your device, attach the DSCs, and then upload it back to the MCA portal. The form needs to be verified and approved by a practicing CA/CS.

Step 5: Submit e-MoA and e-AoA

The Articles of Association (AoA) describe the internal workings of your organisation, while the Memorandum of Association (MoA) outlines its goals.

- Use the e-MoA and e-AoA forms INC-33 and INC-34.

- With SPICe+, these are submitted as connected forms.

- All subscribers must digitally sign this document.

- Printed documents are no longer used in this process; it is entirely digital now.

Step 6: Apply for PAN and TAN

- PAN and TAN are generated automatically after SPICe+ is submitted.

- Issued by the Income Tax Department.

- The Certificate of Incorporation (CoI) includes PAN, TAN and CIN.

- The PAN card is sent through mail, after incorporation at the approximately same time.

- All official documents are delivered digitally and shortly.

Documents Required

For Indian Directors/Shareholders:

- PAN Card

- Aadhaar Card

- Passport-sized photo

- Address proof (bank statement, electricity bill, etc.)

Proof of Premise to be registered

- Rent agreement or property ownership document

- No Objection Certificate from the property owner

For Foreign Nationals:

- Valid passport

- Notarized address proof (utility bill, ID card, etc.)

- National identity proof (translated if not in English)

How much time does it take?

It takes seven to ten working days to complete the procedure if everything is filed correctly. The most common causes of delays are mismatched documents or mistakes in name approval.

Conclusion

Now-a-days, it is much easier and faster than ever to register a private limited company. The majority of formalities are finished in one place because of the SPICe+ form and integrated MCA site, which saves founders time and lessens their compliance load.

Nevertheless, precision is essential. A minor error can lead to delays or rejection. To help you with the process, it is advisable to seek advice from an expert (such as a legal counsel, CS, or CA).

For Professional advice, you can connect with our expert through +91-9267970588 or taxacumen.consultancy@gmail.com